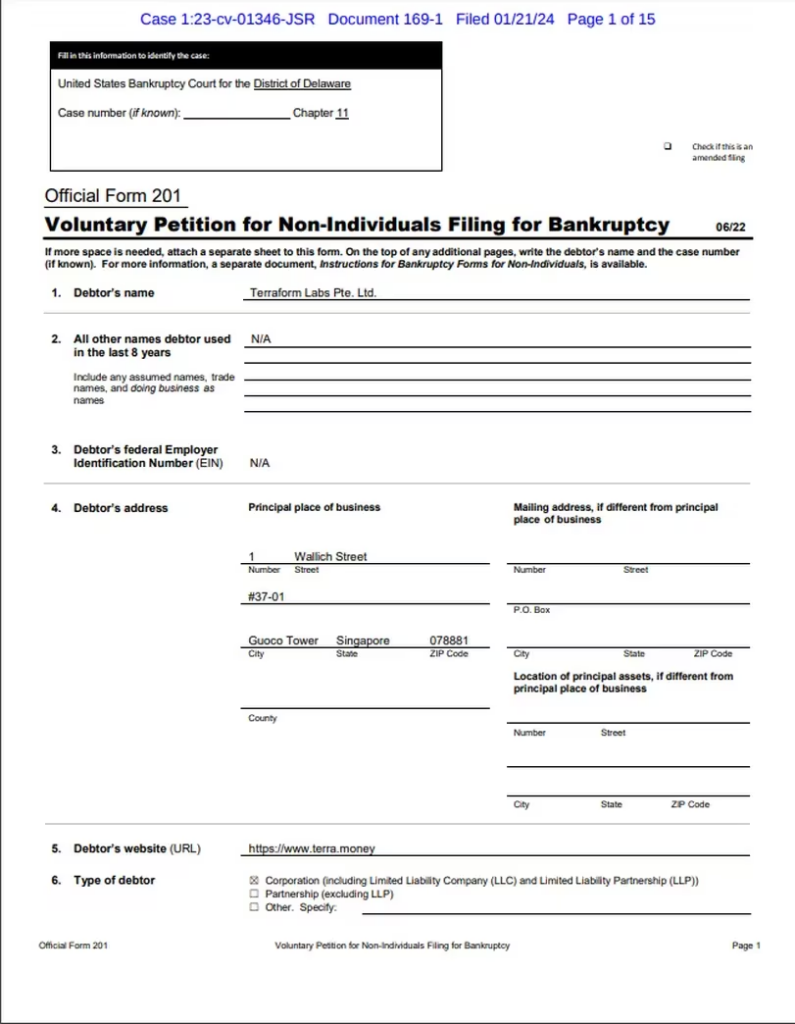

Terraform Labs, the Singapore-based company behind the collapsed algorithmic stablecoin TerraUSD (UST) and its sister currency Luna, has officially filed for Chapter 11 bankruptcy protection in the United States.

The filing, made on Sunday in the Delaware bankruptcy court, comes nearly two years after a catastrophic crash that wiped out billions of dollars from the cryptocurrency market and left countless investors reeling.

Terraform Labs, led by founder Do Kwon, estimates both its assets and liabilities to fall within the range of $100 million to $500 million.

In a statement, the company described the move as a strategic maneuver to “execute on its business plan while navigating ongoing legal proceedings” in both Singapore and the U.S. Kwon, who faces fraud charges from the U.S. Securities and Exchange Commission, is currently awaiting extradition from Montenegro.

The May 2022 implosion of TerraUSD and Luna sent shockwaves through the cryptocurrency ecosystem.

The algorithmic stablecoin, designed to maintain a 1:1 peg with the U.S. dollar, lost its anchor due to algorithmic flaws and a coordinated attack, triggering a death spiral that saw Luna’s price plummet from nearly $200 to fractions of a cent.

Terraform Labs has maintained that the collapse was primarily fueled by external factors and malicious actors, while critics allege systemic flaws and deceptive marketing practices.

The bankruptcy filing is likely to pave the way for a complex legal and financial restructuring process, with creditors and investors vying for a share of the remaining assets.

The ripple effects of Terraform Labs’ bankruptcy are yet to be fully realized. The company’s web3 development plans, which it intends to continue despite the filing, raise questions about the future of its remaining blockchain projects.

Meanwhile, questions linger regarding regulatory oversight and consumer protection within the rapidly evolving cryptocurrency landscape.

As the bankruptcy proceedings unfold, one thing is certain: Terraform Labs’ downfall serves as a stark reminder of the inherent risks associated with algorithmic stablecoins and decentralized finance ventures.

The fallout is likely to shape the regulatory landscape and investor behavior in the cryptocurrency market for years to come.