As Bitcoin surges to a new record high of over AUD 100,000, one of Australia’s largest banks has decided to impose partial restrictions on payments to crypto exchanges, citing concerns over scams and fraud.

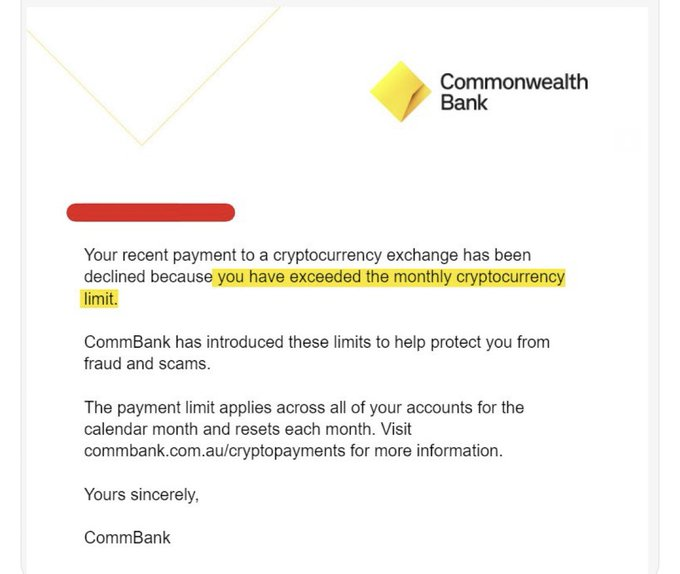

Commonwealth Bank (CBA), which has over 15 million customers, announced on Thursday that it will decline or delay “certain payments” to crypto platforms or limit them to 10,000 AUD per month.

The move has sparked outrage and criticism from the crypto community, who see it as a violation of their economic freedom and a hindrance to web3 adoption.

CBA’s decision to restrict customers from buying crypto is seen by many as a sign of fear and ignorance, as the bank fails to recognize the potential and value of web3 and its applications.

The bank claims that the restrictions are meant to protect customers from scams and fraud, which have increased in recent years as crypto becomes more popular and mainstream.

However, many argue that the restrictions are disproportionate and ineffective, as they punish legitimate and responsible crypto users and developers while doing little to prevent or deter scammers and fraudsters.

Moreover, the restrictions may drive customers away from CBA and towards other banks or payment providers that are more crypto-friendly and supportive of web3.

CBA is not the only bank in Australia that has taken a hostile stance towards crypto and Web3.

Westpac, another major bank, has also banned transfers to some crypto exchanges, including Binance, the world’s largest crypto platform.

These actions contrast with the more progressive and open approach of other banks and financial institutions in the country, such as National Australia Bank (NAB) and ANZ, which have expressed interest in crypto and web3 with partnerships with crypto platforms to experiment with the technology.

According to a recent report by Blockchain Australia, the industry body for the sector, there are over 700 crypto and blockchain companies in the country, employing over 5,000 people and generating over $2 billion in revenue.

The report also highlights the challenges and opportunities for the sector, such as regulation, education, innovation, and collaboration.

CBA’s restrictions on payments to crypto exchanges are a setback for the crypto and Web3 sector in Australia, as they limit the access and choice of millions of customers and potential users.

However, they are also a catalyst for the sector to unite and advocate for its interests and values, and to educate and inform the public and the authorities about the benefits of web3 and its applications.